The Importance of Digital Banking in Today’s Financial World

Introduction

Banking has evolved significantly over the past decade, with digital banking becoming an essential part of modern financial life. Traditional banking methods are rapidly being replaced by online and mobile banking solutions that offer convenience, speed, and security. Understanding how digital banking works and why it matters can help individuals and businesses manage their finances more efficiently.

What Is Digital Banking?

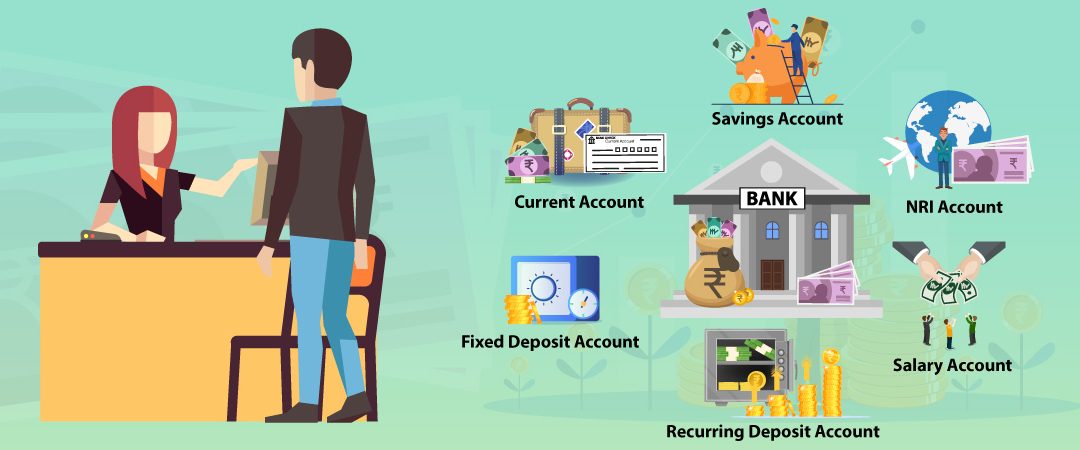

Digital banking refers to the use of online platforms and mobile applications to access banking services. These services include checking account balances, transferring funds, paying bills, applying for loans, and managing savings accounts all without visiting a physical bank branch.

Most banks today offer digital banking features as part of their standard services, making it easier for customers to handle their financial needs anytime and anywhere.

Benefits of Digital Banking

One of the biggest advantages of digital banking is convenience. Customers can access their accounts 24/7, avoiding long queues and limited banking hours. This is especially useful for people with busy schedules.

Another major benefit is cost efficiency. Digital banking often reduces operational costs for banks, which can result in lower fees and better interest rates for customers.

Security has also improved significantly. Modern banks use encryption, two-factor authentication, and fraud detection systems to protect users’ data and transactions.

Digital Banking and Financial Inclusion

Digital banking plays a crucial role in financial inclusion by providing access to banking services for people in remote or underserved areas. With just a smartphone and internet connection, individuals can open accounts, save money, and make digital payments without relying on traditional bank branches.

This accessibility helps promote financial literacy and encourages better money management habits.

Challenges in Digital Banking

Despite its advantages, digital banking also faces challenges. Cybersecurity threats, data privacy concerns, and lack of digital literacy among some users remain key issues. Banks continue to invest in technology and customer education to overcome these challenges and build trust.

Conclusion

Digital banking has transformed how people interact with financial institutions. It offers convenience, efficiency, and accessibility, making it an essential part of today’s banking system. As technology continues to advance, digital banking will play an even greater role in shaping the future of finance.