How Online Banking Is Changing the Way We Manage Money

Introduction

Online banking has revolutionized the financial industry by making banking services faster, easier, and more accessible. What once required visits to physical bank branches can now be done with just a few clicks. As technology continues to advance, online banking is becoming the preferred choice for millions of users worldwide.

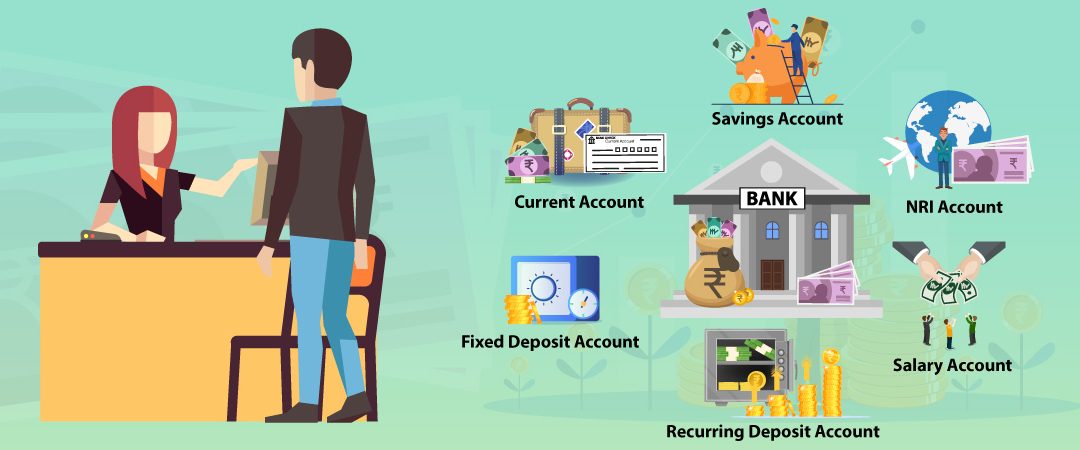

What Is Online Banking?

Online banking allows customers to access their bank accounts through websites or mobile applications. Users can check balances, transfer funds, pay bills, apply for loans, and manage savings accounts without visiting a bank branch.

Most traditional banks now offer online banking services alongside digital-only banks that operate entirely online.

Key Benefits of Online Banking

One of the biggest advantages of online banking is convenience. Customers can perform transactions at any time, eliminating the need to follow bank working hours.

Another benefit is speed. Transactions such as fund transfers and bill payments are processed quickly, saving valuable time. Online banking also helps users track their spending through transaction histories and alerts.

Cost savings are another factor. Many online banks offer lower fees and better interest rates due to reduced operational costs.

Security Measures in Online Banking

Security is a major concern for users, and banks have invested heavily in protecting customer data. Features such as encryption, biometric login, two-factor authentication, and real-time fraud monitoring help ensure secure transactions.

Customers are also encouraged to use strong passwords and avoid accessing banking apps on public networks.

Challenges of Online Banking

Despite its advantages, online banking may not be suitable for everyone. Limited internet access, lack of digital skills, and concerns about cybercrime can discourage some users. Banks continue to educate customers and improve systems to address these challenges.

Conclusion

Online banking has transformed money management by offering flexibility, speed, and enhanced control over finances. As digital adoption increases, online banking will continue to shape the future of the global banking system.