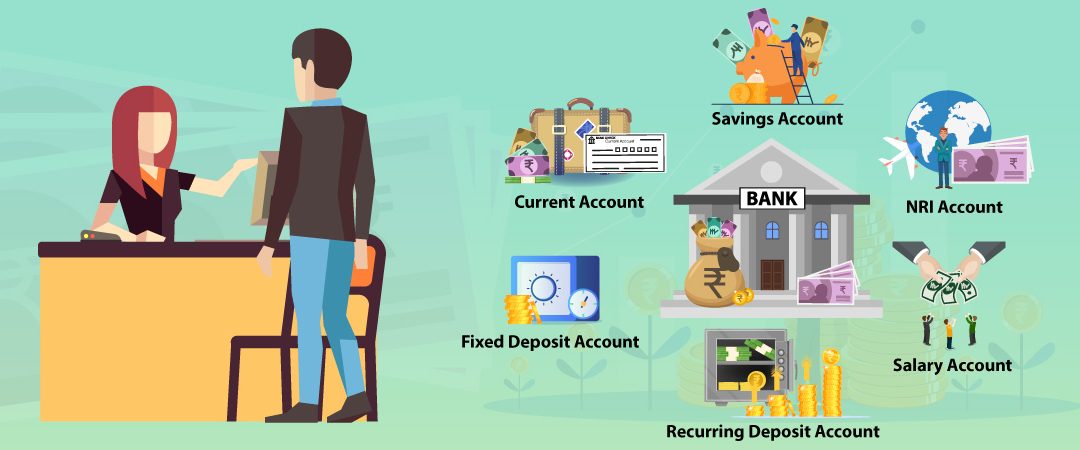

Understanding Different Types of Bank Accounts and Their Uses

Introduction

Choosing the right bank account is an important step in managing personal finances effectively. Banks offer various types of accounts designed to meet different financial needs. Understanding these options can help individuals make informed decisions and optimize their money management.

Savings Accounts

Savings accounts are designed to help individuals save money while earning interest. They are ideal for emergency funds and short-term savings goals. These accounts usually offer lower risk and easy access to funds.

Checking Accounts

Checking accounts are used for daily transactions such as bill payments, withdrawals, and purchases. They often come with debit cards and online banking features. While checking accounts usually offer little to no interest, they provide high liquidity and convenience.

Fixed Deposit Accounts

Fixed deposit accounts allow customers to invest a fixed amount of money for a specific period at a predetermined interest rate. These accounts are suitable for individuals seeking stable returns with low risk.

Business Accounts

Business accounts are designed for companies and entrepreneurs to manage business transactions. They often include features such as bulk payments, invoicing tools, and higher transaction limits.

Choosing the Right Account

The best bank account depends on individual financial goals, income level, and spending habits. Many people use a combination of accounts to manage savings, daily expenses, and long-term investments.

Conclusion

Understanding different types of bank accounts helps individuals manage money more efficiently. By selecting the right accounts, users can improve financial organization, earn interest, and achieve their financial goals more effectively.